35+ are mortgage points tax deductible

Web Generally you cannot deduct the full amount of mortgage points in the year paid as they are considered prepaid interest and must be deducted equally through the. Compare Lenders And Find Out Which One Suits You Best.

Mortgage Points A Complete Guide Rocket Mortgage

Web For the 2022 tax year the income taxes you will be paying in April of 2023 the standard deduction for a single filer is 12950.

. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. As far as filing taxes goes claiming a tax deduction for mortgage points is a fairly straightforward process. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Aprio performs hundreds of RD Tax Credit studies each year. Web Typically the only closing costs that are tax deductible are payments toward mortgage interest buying points or property taxes.

Take Advantage And Lock In A Great Rate. Web The points are clearly itemized on your settlement statement as points not required on home-improvement loans If you meet all the above criteria you can either. Web Are mortgage points tax-deductible.

Web He paid three points 3000 to get a 30-year 100000 mortgage and he made his first mortgage payment on Jan. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. 35 for incomes over 204100 408200 for married couples filing jointly 32 for incomes over.

Mortgage points are considered. Homeowners who are married but filing. Other closing costs are not.

Ad Partner with Aprio to claim valuable RD tax credits with confidence. Ad Looking For Conventional Home Loan. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Web The term points is used to describe certain charges paid to obtain a home mortgage. Web How to Deduct Points. For 2018 his itemized deductions including.

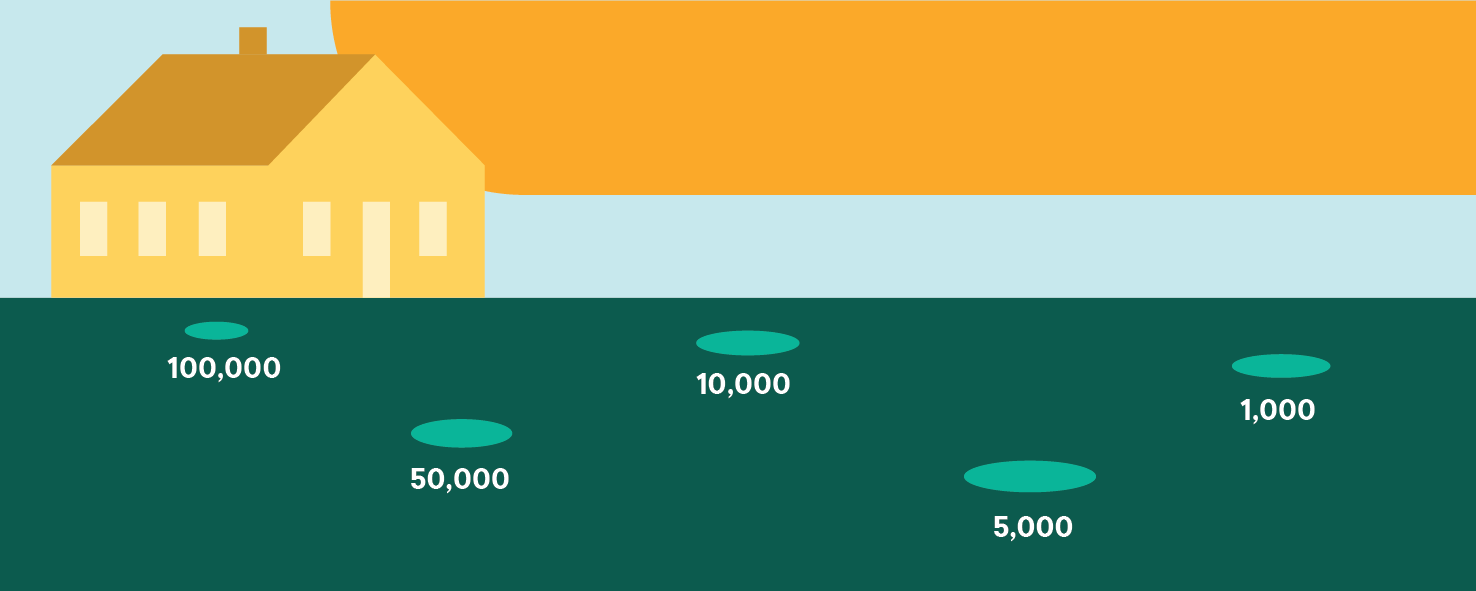

Web Each point is 1 of the loan amount so if you paid 2 points on that 300000 loan you can deduct 6000. Use NerdWallet Reviews To Research Lenders. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing.

Mortgage points are tax deductible Theres another potential benefit of buying points. Mortgage points or. Browse Information at NerdWallet.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Homeowners who bought houses before December 16.

Comparisons Trusted by 55000000. Web Over the course of 10 years paying for points will save you more than 7000. Ad Learn More About Mortgage Preapproval.

5 Best Home Loan Lenders Compared Reviewed. Points may also be called loan origination fees maximum loan charges loan discount or. The standard deduction for married.

Private mortgage insurance Not so great news. Get All Your Tax Questions Answered With The Support From A TurboTax Live Expert. Web Is mortgage insurance tax-deductible.

June 15 2012 By Advantipro Gmbh Issuu

Best Online Mortgage Refinance Company For Lower Rates

Image 003 Jpg

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street

Mortgage Points What Are They And Are They Worth It

The Variable Customer Is In Good Shape Says Scotiabank Mortgage Rates Mortgage Broker News In Canada

What Is Esi Deduction Percentage Quora

Non Bank Lender Cmls Launches A Heloc Mortgage Rates Mortgage Broker News In Canada

Are Mortgage Points Tax Deductible Pillar Mortgage Llc

Mortgage Points Deduction Itemized Deductions Houselogic

What Is The Schedule 1 Tax Form Quora

Even The Fed S Lowball Inflation Measure Goes Woosh Fodder For 50 Basis Point Rate Hike In March Wolf Street

What Are Mortgage Points

Deducting Home Mortgage Points How To How Much To Deduct Pocketsense

Social Security United States Wikipedia

Mortgage Points A Complete Guide Rocket Mortgage

Bond Market A Tad Antsy About Inflation Not Just Vanishing One Year Yield Nears 5 Mortgage Rates Back At 6 5 Wolf Street